Transaction Screening

Powering a no-compromise payment experience

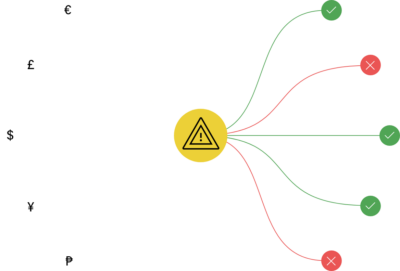

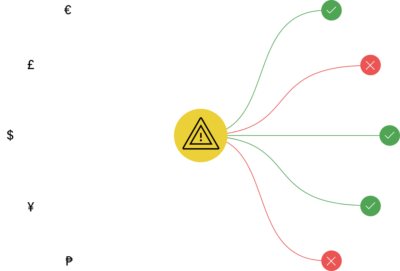

- Higher straight-through processing without compromising on risk

- Reduce false positives with risk-optimized matching algorithms

- Boost sanctions compliance with the most up-to-date data on the market

- Improve efficiency with integrated data, screening, and case management

Want to see it in action?

Request Demo

Payment Screening purpose-built for speed

of payments processed without delay

Provide the best experience to your customers with data-optimized screening algorithms.

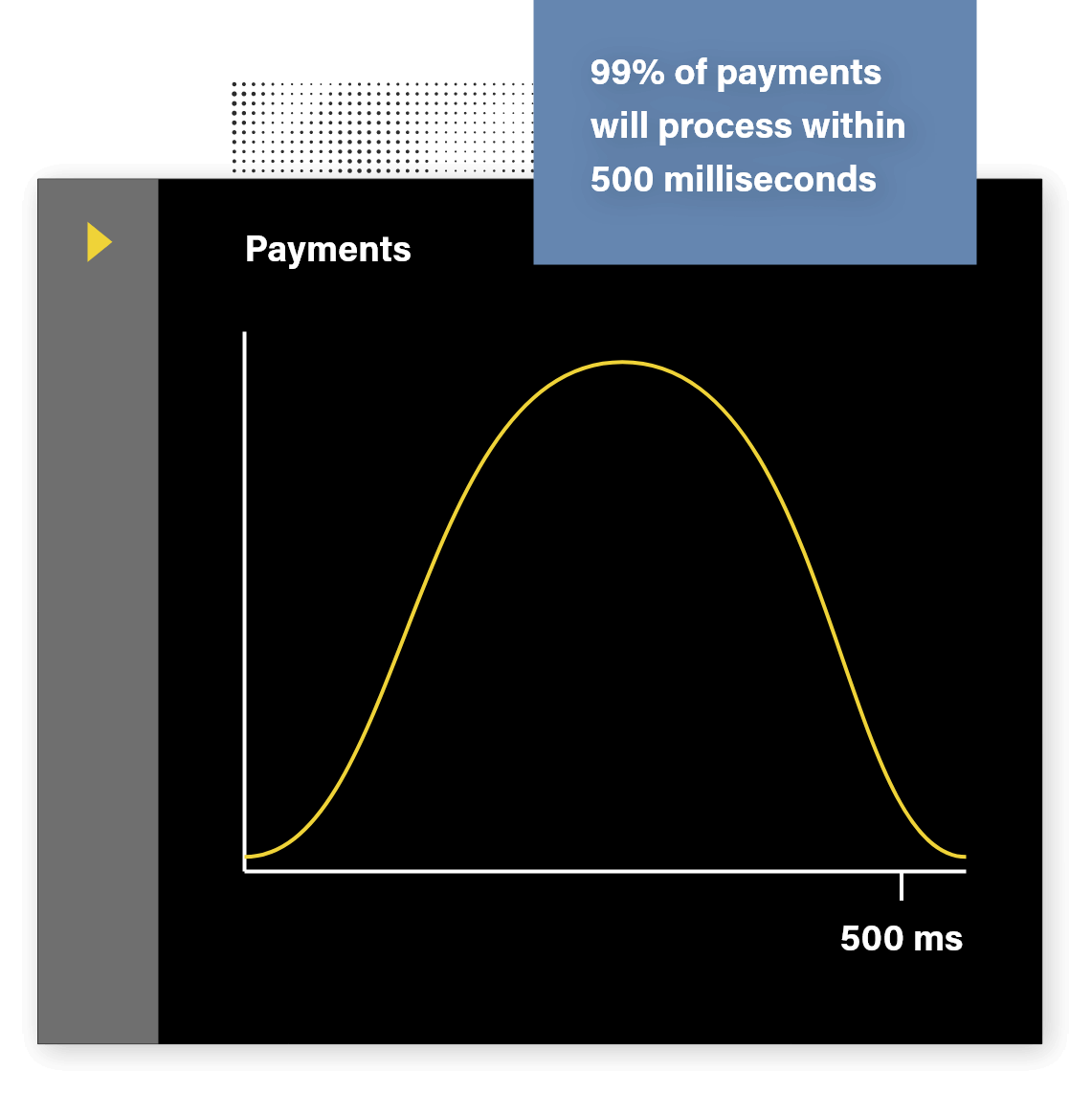

required to process 99% of payments

Fully support instant payments without compromising on risk using scalable cloud technology.

for system-wide updates to sanction lists

Screen against up-to-date data during any crisis using automated, human-validated list updates.

A better way to screen transactions

- We source our data directly from regulators using advanced NLP technology tagged as best-in-class by Chartis (2022)

- 100+ partners already trust our global coverage and industry-validated datasets:

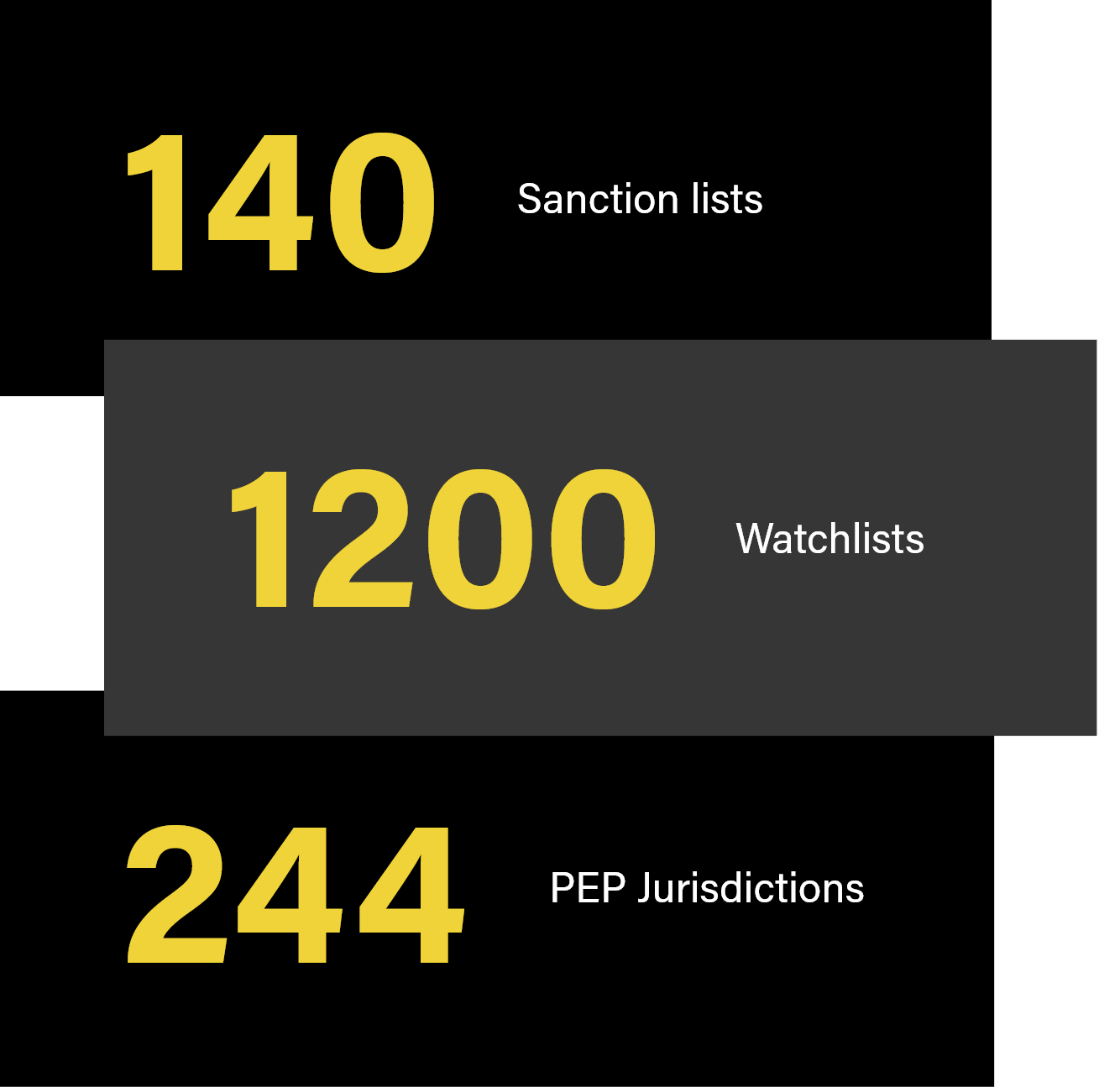

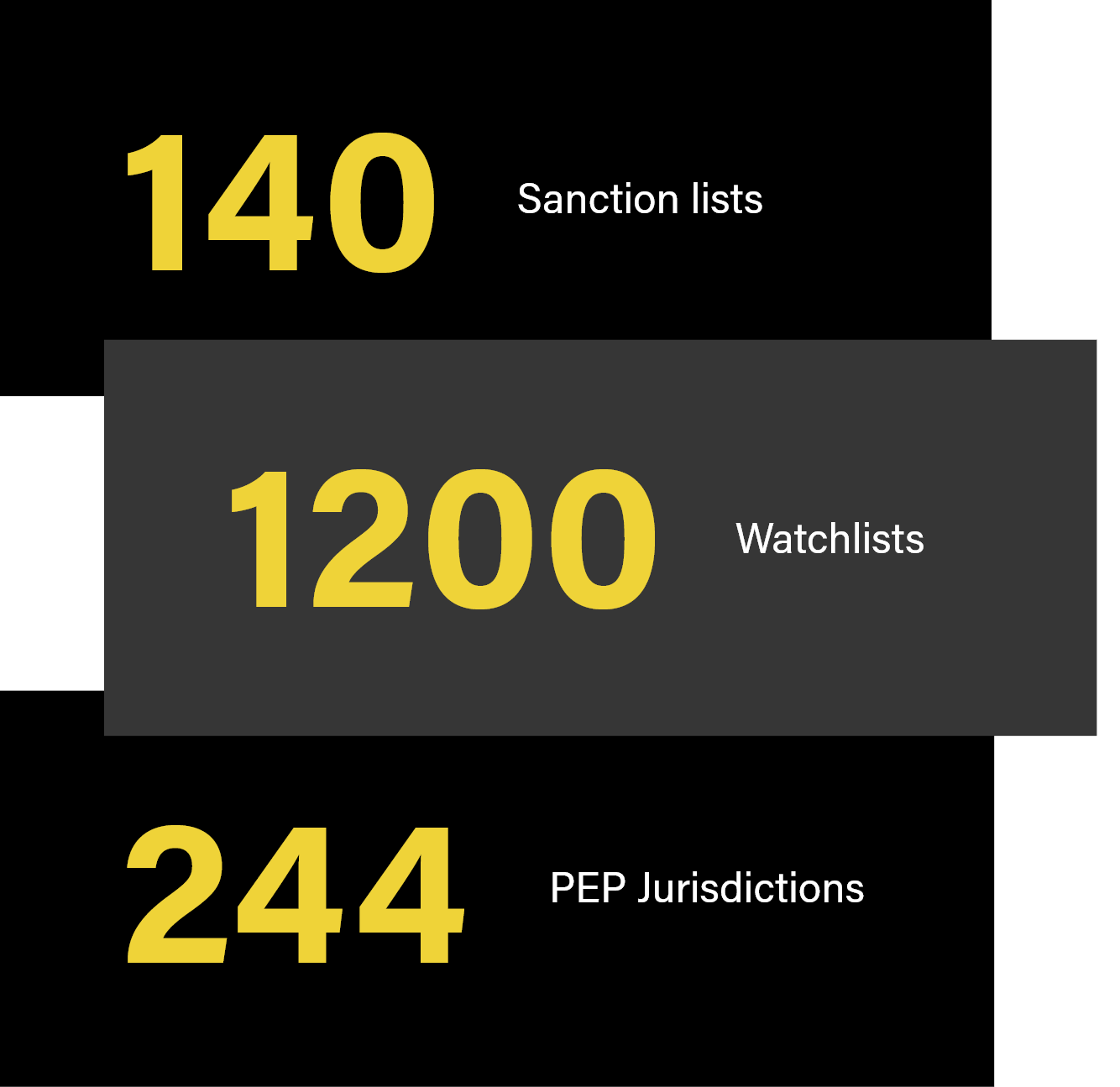

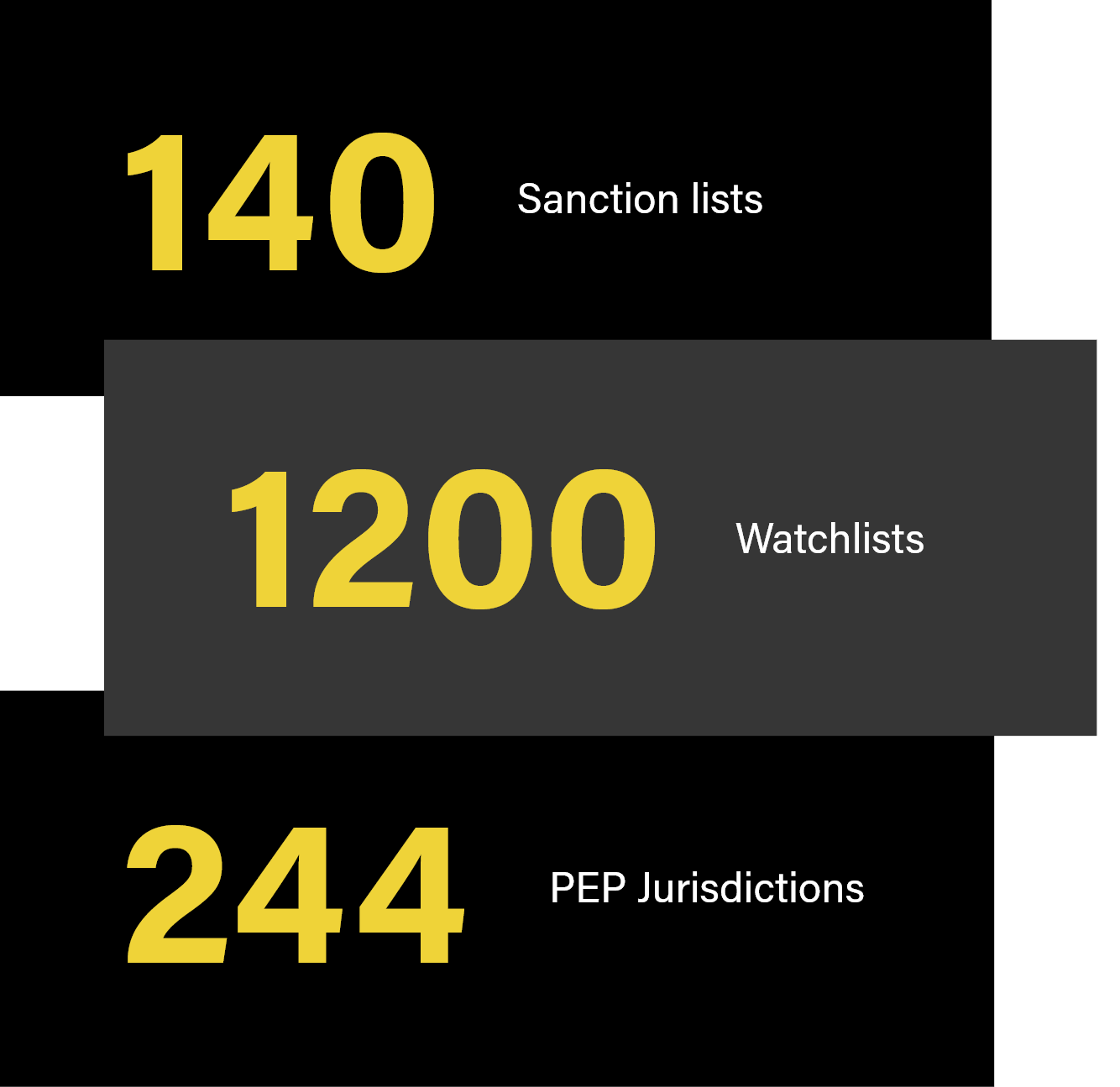

140 Sanction lists | 1200 Watchlists | 244 PEP Jurisdictions - Rich profiles provide analysts with comprehensive information for accurate and fast decisions.

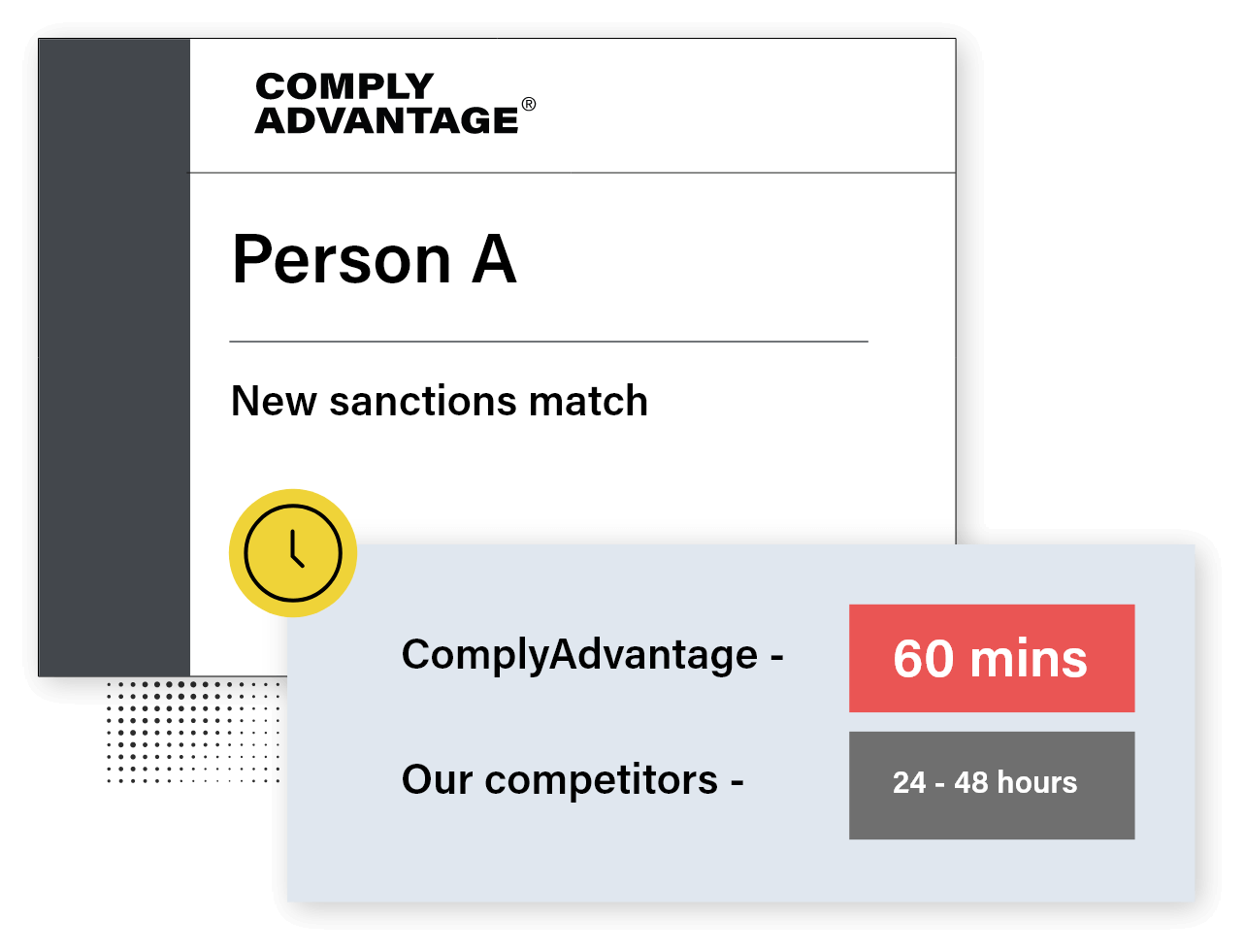

- Our advanced technology directly monitors regulators for updates – no more waiting for regulatory notices.

- Start screening against updated lists in as little as 60 minutes.

- Expert QA: Our dedicated global analyst team ensures that only correct updates are made.

- Optimized algorithms calibrated to our data power fast, accurate screening flexibility, and higher STP rates.

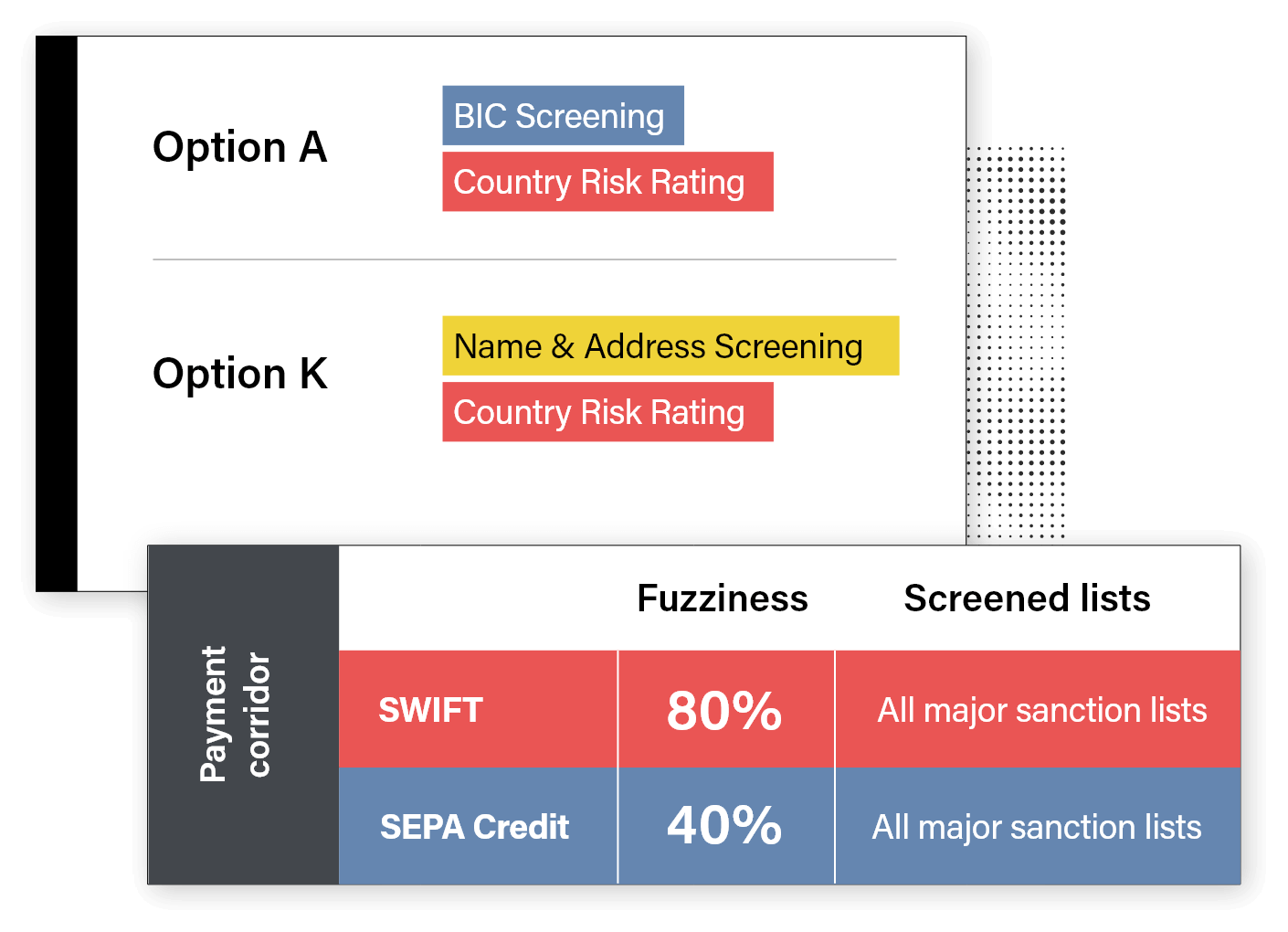

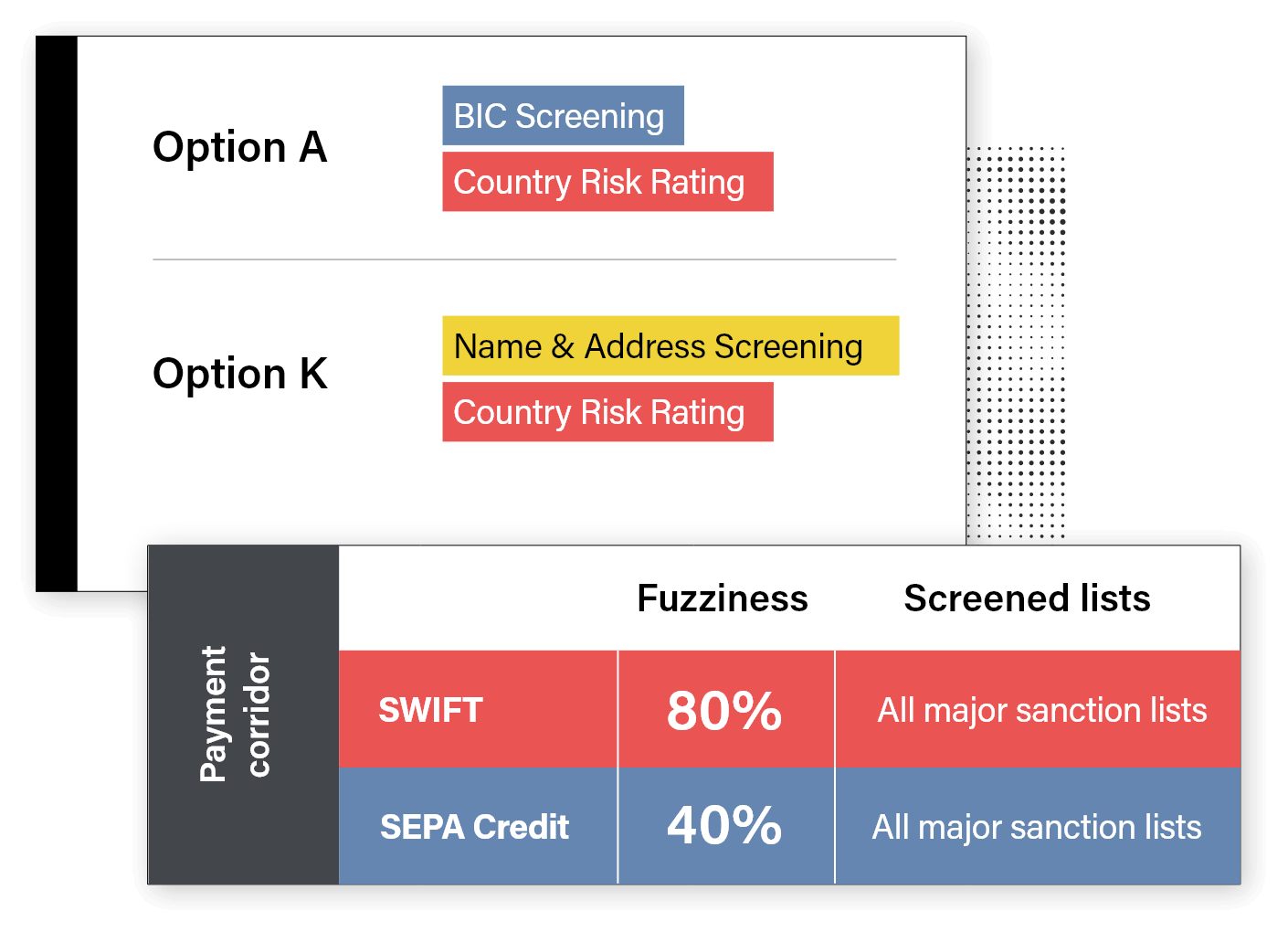

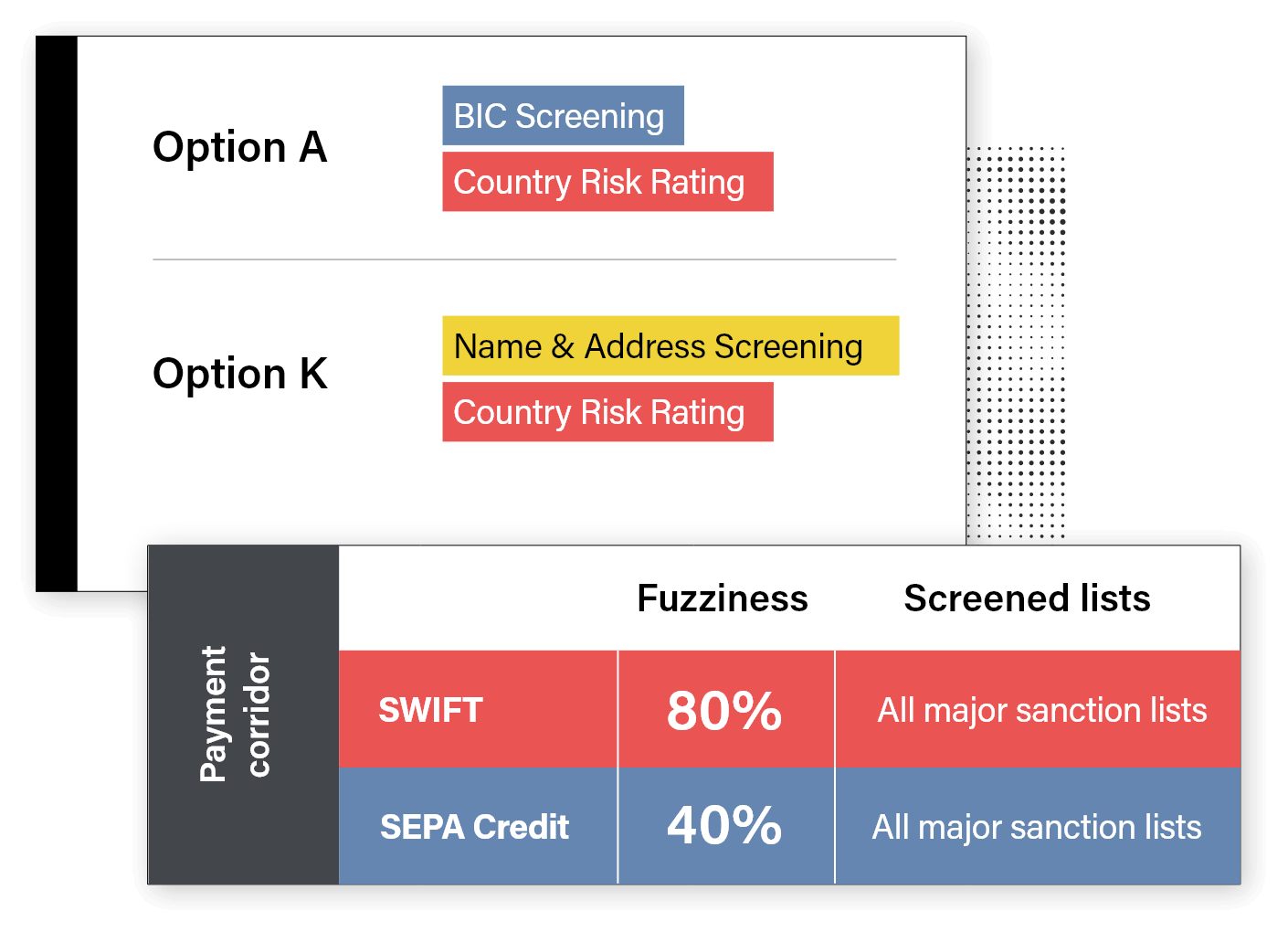

- Screen any payment attribute, including names, BIC codes, countries – even unstructured text fields.

- Customizable screening profiles: Apply tailored lists and fuzziness levels to different payment corridors – for a differentiated, risk-based payments approach.

- Screening as fast as 150 to 500 milliseconds supports any faster payment scheme (including Instant SEPA Credit, Faster Payments, and FedNow.)

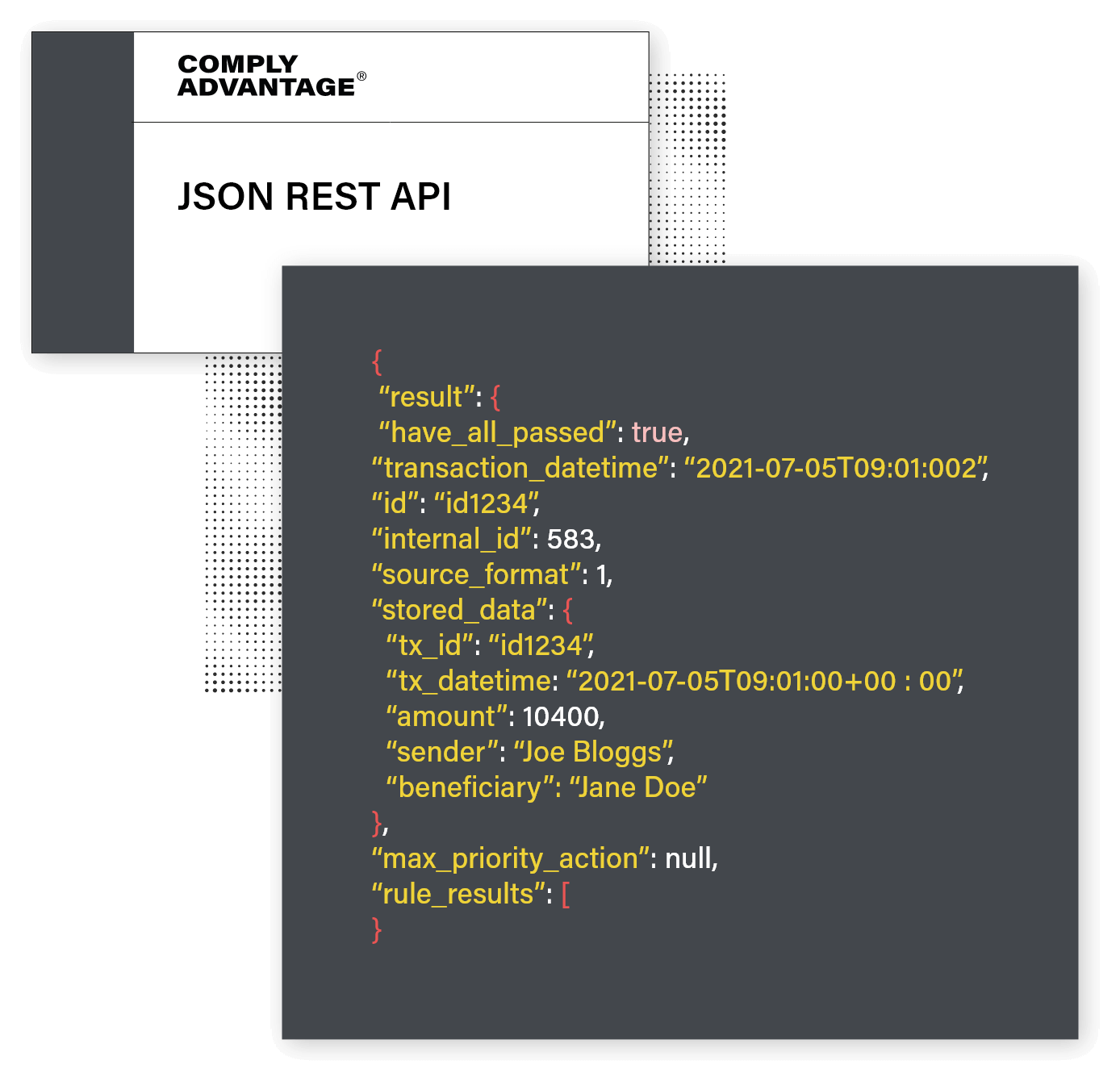

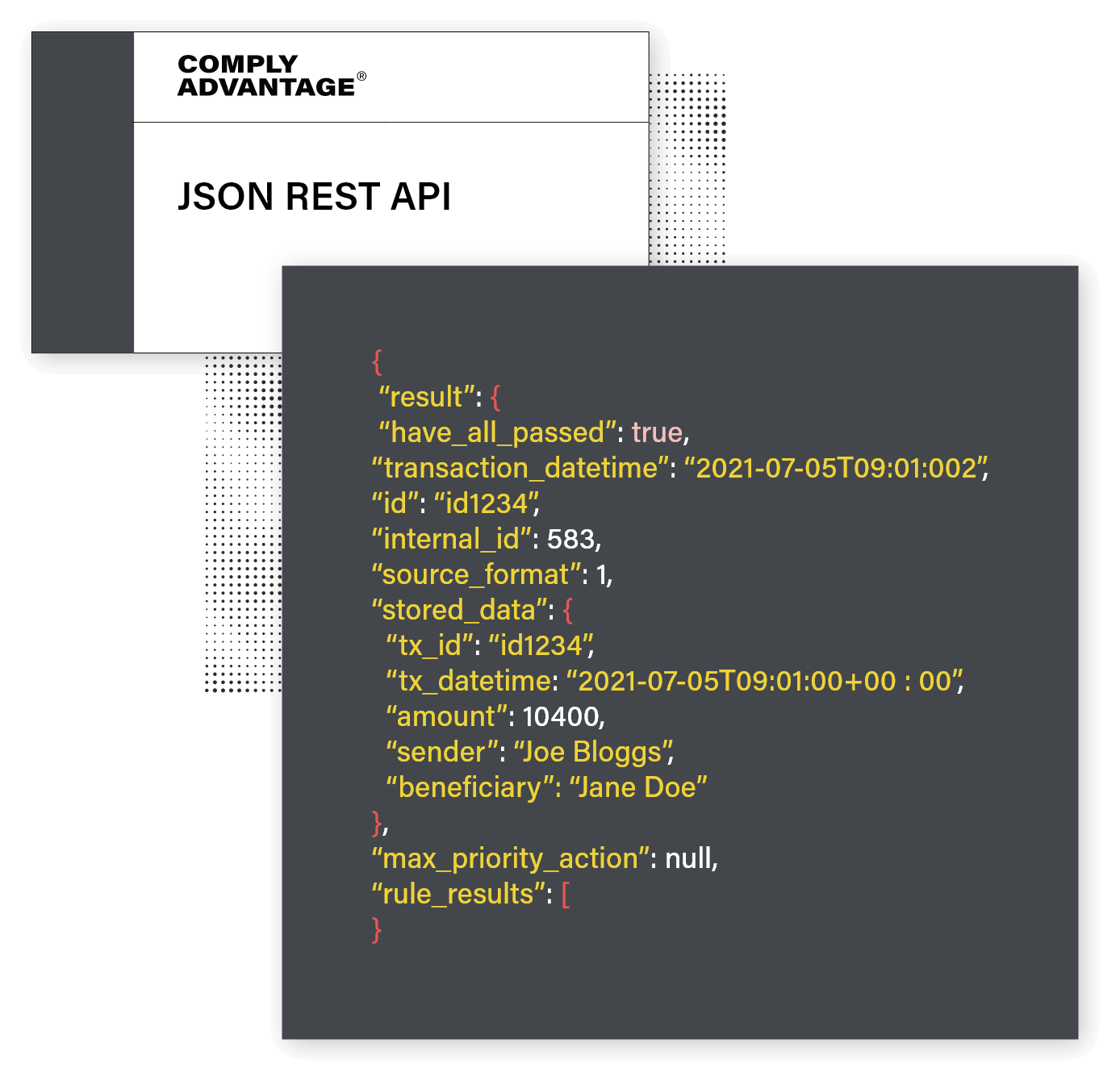

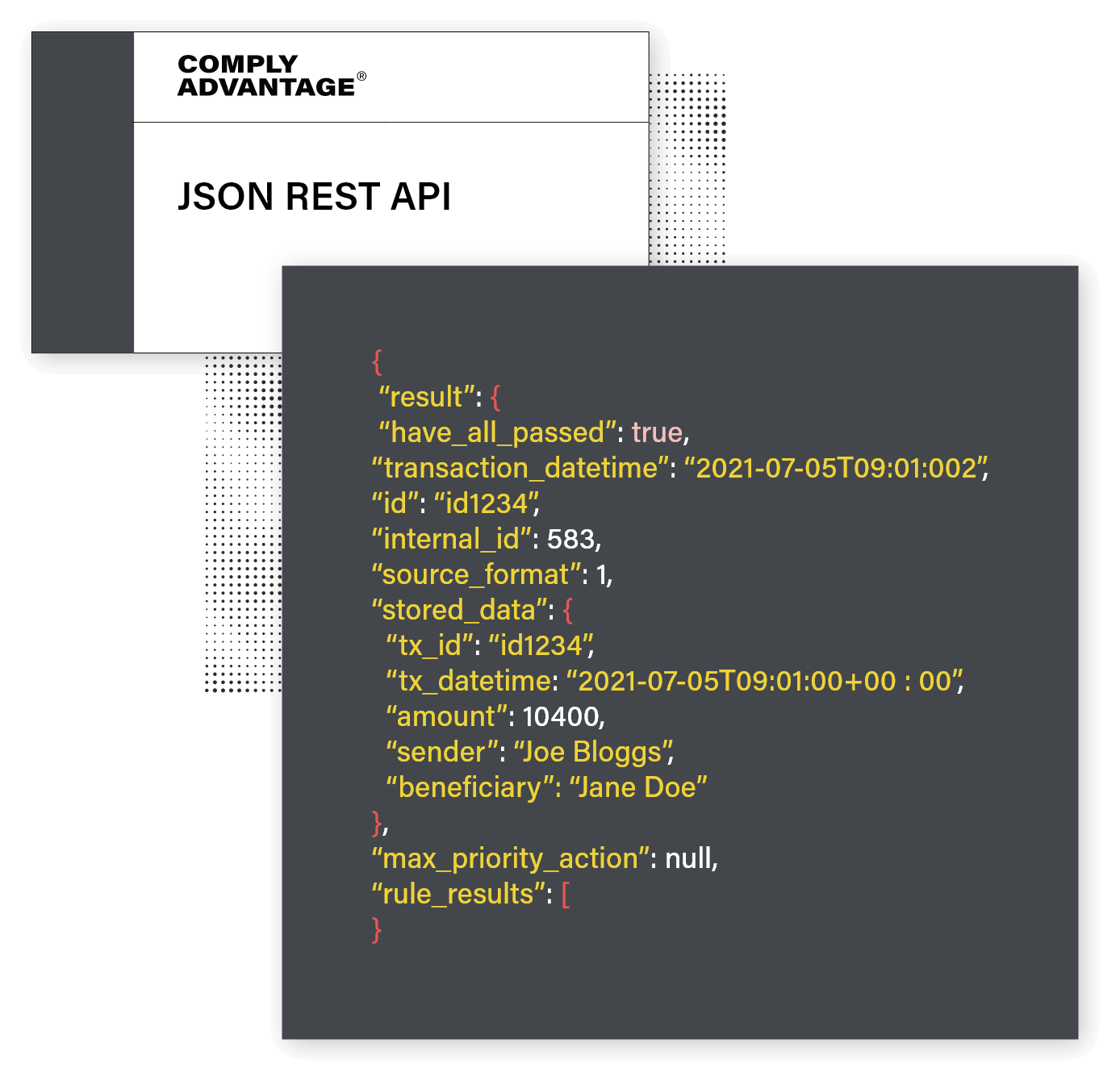

- Seamless integration with our JSON REST API

- Out-of-the-box integration with several core banking platforms.

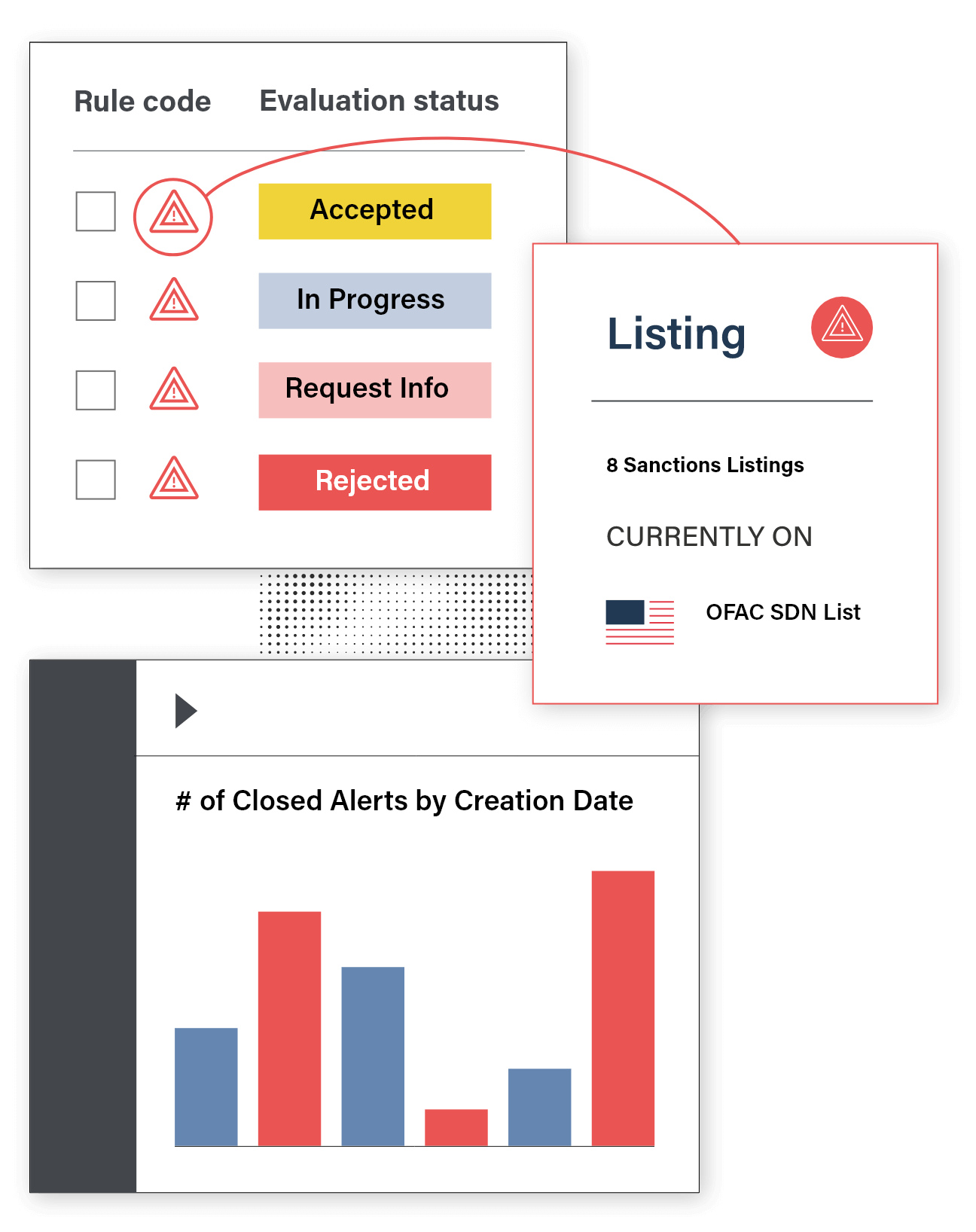

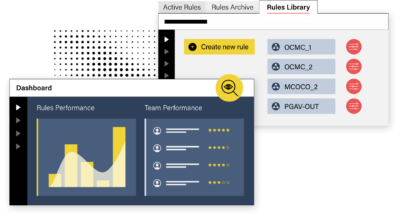

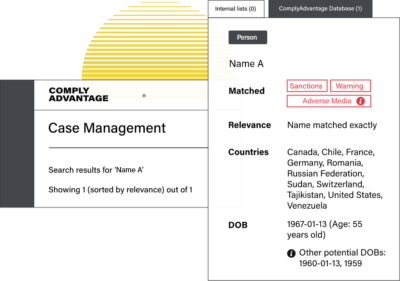

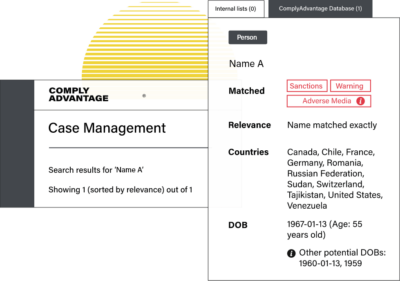

- Work more efficiently with a flexible workflow.

- Keep tabs on alert queue statuses with an out-of-the-box dashboard.

How our transaction screening solution works

Explore our related fraud and AML solutions

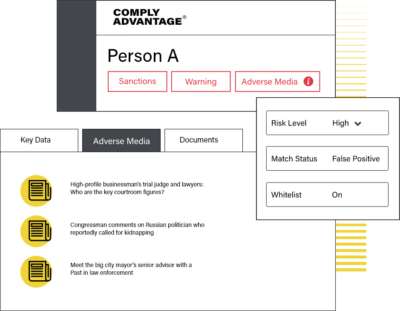

Sanctions & Watchlist Screening

Automate ongoing monitoring by screening and monitoring customers against sanctions, global watchlists, and politically exposed persons (PEPs).

Discover Sanctions & Watchlist Screening

Transaction Monitoring

Powered by AI, our transaction monitoring solution offers a no-code, self-serve rules builder and can be scaled to billions of transactions.

Discover Transaction Monitoring

Adverse Media Screening

Cut through the noise and analyze true adverse media context at scale with our robust adverse media screening software.

Discover Adverse Media Screening

Get started with ComplyAdvantage today

See how our AI-powered transaction screening capabilities can help you see the unseen.

Request Demo